40+ Mortgage affordability calculator income

Most lenders do not want your monthly mortgage payment to exceed 28 percent of your. Supported by our housing finance activities.

Dave Ramsey S Baby Steps That Work Like Magic 4 Is A Surprise Emergency Fund Saving Budgeting Money Budgeting Finances

The Federal Housing Administration FHA and the Federal Savings Loan Insurance Corporation.

. Total of 360 Monthly Payments. Get pre-approved with a lender today for exact numbers on what you can afford. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Housing is considered affordable if it costs less than 30 of a households before-tax income. Calculate Your Mortgage Qualification Based on Income.

30 Years Term of Loan. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. You can use the slider to change the percentage of your income you want spend on housing.

Using our calculator above you can estimate the savings difference conveniently. 30-year Fixed-rate Home Loan Summary. In an effort to strengthen the residential mortgage market Congress passed the National Housing Act of 1934.

Excluding housing costs Expected down payment. Once your mortgage balance falls beyond a certain amount such as around 50000 its likely not worth remortgaging with a new lender. Affordability Calculator How much house can you afford.

Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances. Go to Intermediaries Mortgage Products and Lending Criteria. How does the affordability calculator work.

Income and the calculator will display rentals up to 40 of your estimated gross income. Below are some of the common questions we receive around affordability and the required income calculator. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage.

A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. Interest Only Amount. The following table compares costs between monthly mortgage.

The affordability assessment can be performed on Single or Joint applicants using the appropriate selection. This paved the way for two new agencies. The calculator also allows the user to select from debt-to-income ratios between 10 to 50 in increments of 5.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. By 1933 around 40 to 50 percent of all residential mortgages in the United States were in default. Our calculator includes amoritization tables bi-weekly savings.

If you use the additional options we deduct the rent from your income and. DTI is a percentage and represents your total minimum monthly debt divided by your monthly income. Sometimes these loans are called 80-10-10 loans.

The calculator below also accounts for other homeownership costs such as real estate taxes homeowners insurance and HOA fees. In addition to housing costs your total monthly debt load would include credit card interest car payments and other loan expenses. While determining mortgage size with a calculator is an essential step it wont be as accurate as talking to a lender.

If your mortgage balance is already small. Use our free mortgage calculator to estimate your monthly mortgage payments. Some second mortgage loans are only 10 percent of the selling price requiring you to come up with the other 10 percent as a down payment.

This rent affordability calculator from Zillow uses your specific financial situation to help you decide. Our mortgage loan insurance for example helps borrowers get financing at competitive rates. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for.

Lenders want to ensure you can pay your mortgage so theyll typically only approve you if your annual payments are less than 30 of your annual income. Mortgage Required Income Calculator FAQs. Should not be more than 40 of your gross monthly income.

Other lenders may no. Payment frequency for your mortgage meaning either monthly or bi-weekly. Most people need a mortgage to finance a home purchase.

Income 1 Income 2 Multiple Amount. If coupled with down payments less than 20 05 of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans. This mortgage affordability calculator helps you figure out how much house you can afford by analyzing your monthly income existing debts and assumed payment level.

You wont make enough savings because of the high fees. To calculate how much rent you can afford we multiply your gross monthly income by 20 30 or 40 based on how much you want to spend. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining.

Select the term of the mortgage and the repayment type Term years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36. Youve taken the first step to financial freedom by using this calculator but dont forget to check. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Type -- Purchase Price Property Value. Use this calculator to figure home loan affordability from the lenders point of view. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Private mortgage insurance PMI you made a 20 down payment worth 65000. In this scenario you take out a primary mortgage for 80 percent of the selling price then take out a second mortgage loan for 20 percent of the selling price. Account for interest rates and break down payments in an easy to use amortization schedule.

Please enter a term1-40 Repayment Basis. Check out the webs best free mortgage calculator to save money on your home loan today. The housing expense or front-end ratio is determined by the amount of your gross income used to pay your monthly mortgage payment.

40 Best Free Material Design Bootstrap Templates 2021 Bootstrap Template Material Design Portfolio Template Design

Ultimate Free Printable Monthly Expense Tracker Pdf Video Tutorial Budget Expenses Debt Payoff Expense Tracker

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

Download Excel Budget Template Xls Project Management Excel Templates Xlstemplates Excel Budget Template Excel Budget Budget Template Excel Free

Debt To Income Ratio Formula Calculator Excel Template

Shop Budget Boss Binder Who Says What Video Video Debt Repayment Budgeting Finances Budgeting Money

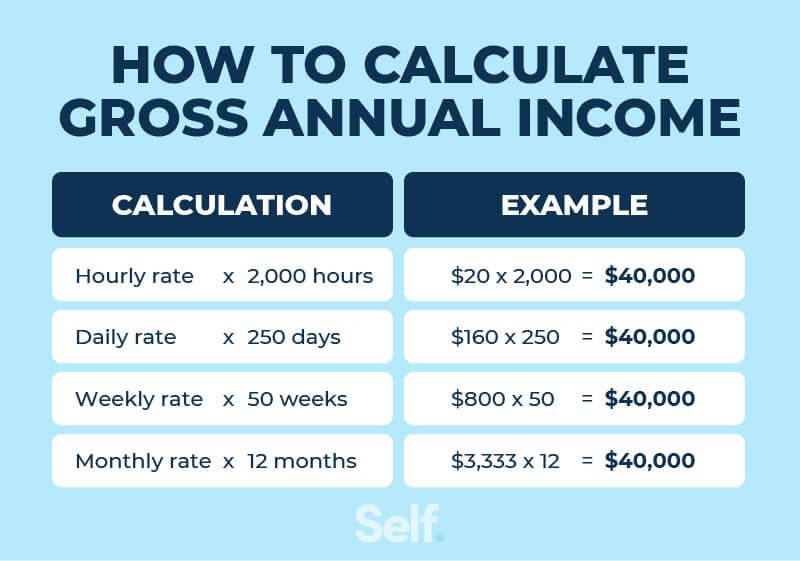

What Is Annual Income And How To Calculate It Self Credit Builder

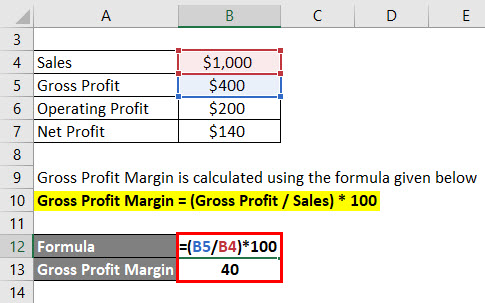

Income Statement Formula Calculate Income Statement Excel Template

Financial Organizer Debt Payoff Coloring Pages Etsy Paying Off Credit Cards Credit Card Tracker Debt Payoff Printables

How Much Should You Spend On That Life And My Finances

Pin On Financial Infographics

How To Write A Loan Payment Acknowledgement Letter Download This Loan Payment Acknowledgement Letter Templat Lettering Letter Templates Free Collection Letter

Credit Cards Numbers That Work Order 1578609875 On Jan 28 2020 Credit Card Tracker Credit Card Payment Tracker Credit Card Payoff Plan

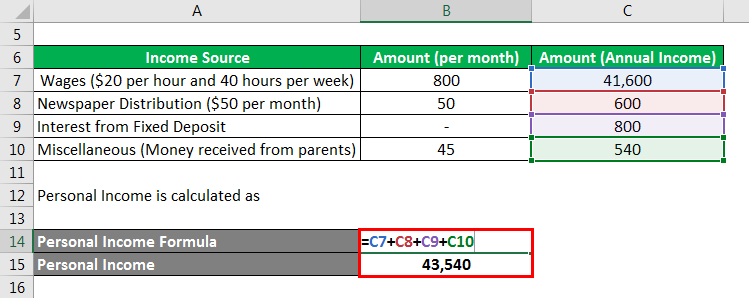

Personal Income Examples Explanation With Excel Template

Tumblr Loan Application Application Form Personal Loans